A portfolio is a store of economic activity in a set of instruments mastered in the LUSID Security Master.

There are three types of portfolio:

A transaction portfolio enables you to load transactions and other activity in order to build holdings (positions).

A derived transaction portfolio enables you to perform pre-trade what-if analysis on a live parent transaction portfolio.

A reference portfolio enables you to model an index such as the FTSE 100 or S&P 500.

Note: Once created, you can only change certain characteristics of a portfolio, and only in some circumstances. More information.

There are several ways to group, nest or relate portfolios:

A portfolio group collates similar portfolios together, for example an

EMEAportfolio group that acts as an umbrella forUK,FRandDEportfolios. You can list transactions and holdings for all the portfolios in a portfolio group, and also value the entire group.A composite portfolio has a special kind of relationship with one or more constituent portfolios. You can aggregate performance returns for the composite portfolio and for its constituents to assess overall performance.

A fund of funds parent portfolio has one or more child portfolios securitised as instruments and purchased as assets in the parent. You can value the parent and drill down (or ‘lookthrough’) to see scaled valuations for individual holdings in child portfolios.

Note the following about all types of portfolio:

A portfolio has a creation date that you can set to be in the past in order to load historical activity.

A portfolio has a single identifier consisting of a

scopeandcode(the latter must be unique within the former). More about identifiers.A portfolio has a base (or reporting) currency to which LUSID can normalise foreign currencies in order to provide meaningful valuation reports.

A portfolio can have a recipe, which is nominally optional but actually required to enable LUSID functionality such as instrument events, and also to generate holdings for complex instruments that require market data (such as floating rate bonds).

A portfolio has a minimal set of mandatory data fields, but you can extend the data model by adding custom properties in the normal way.

You can create relationships to certain other types of entity, for example between a portfolio and the person(s) who manage that portfolio.

You can apply access metadata to a portfolio. This may be a more effective way of restricting access to portfolio data stored in LUSID.

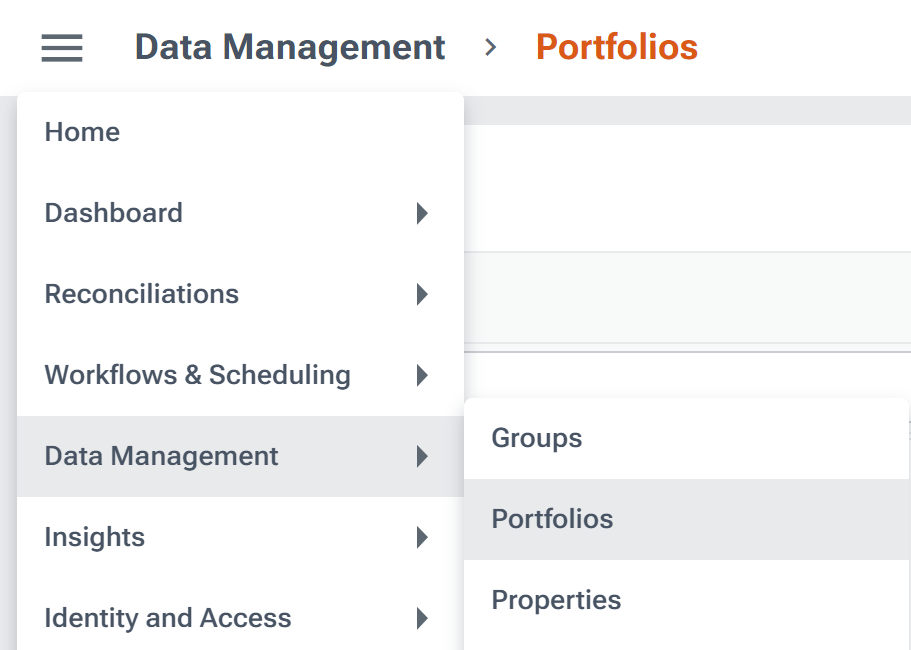

Providing you have suitable access control permissions, you can interact with portfolios using the Data Management > Portfolios dashboard in the LUSID web app:

Alternatively, you can interact with portfolios programmatically:

For any type of portfolio, using the API endpoints in the Portfolios collection, plus:

For a transaction portfolio, the API endpoints in the Transaction Portfolios collection.

For a derived transaction portfolio, the API endpoints in the Transaction Portfolios and Derived Transaction Portfolios collections.

For a reference portfolio, the API endpoints in the Reference Portfolios collection.

Using the equivalent methods in the LUSID SDK.

If you have a Luminesce license, using dedicated read and write providers.

Explanation: See the big picture

Tutorials: Get started by doing something tangible

Reference: Understand concepts and implications

How-to guides: Get something done