An instrument mastered in LUSID represents a financial asset you own or have exposure to. Every transaction booked into LUSID in any portfolio must resolve to an instrument stored in the central repository that is the LUSID instrument master. See the set of supported instruments.

You can master the following types of asset in LUSID:

Currencies. We prepopulate your LUSID domain with a basket of currencies, but you can create a new currency if this becomes necessary.

Simple instruments such as equities.

Complex OTC or exchange-traded contracts such as futures, FxForwards, bonds, CFDs, options and more.

An entire portfolio (should you wish to securitise a fund for benchmarking or other purposes).

To master an instrument, you specify an economic definition, particular to the type of asset, optionally in a custom instrument scope. You can also add custom properties to record additional information if you wish.

Additionally, you specify a set of identifiers for an instrument. Each identifier maps the instrument to a particular security identification scheme, whether this is to an open standard such as FIGI or PermID, an industry scheme such as ISIN, CUSIP or SEDOL, or to your own internal security database. When data is loaded into LUSID from different sources—each likely referencing the same financial asset using a different identifier—it can be automatically resolved to the same, correct instrument. In this way, LUSID consolidates data from different sources, guaranteeing a consistent economic impact but without transforming the ingested data in any way, so it remains meaningful to the originating system.

Note: LUSID is transitioning to a model where it automatically emits lifecycle events for mastered instruments, enabling you to handle those events in a seamless and consistent manner.

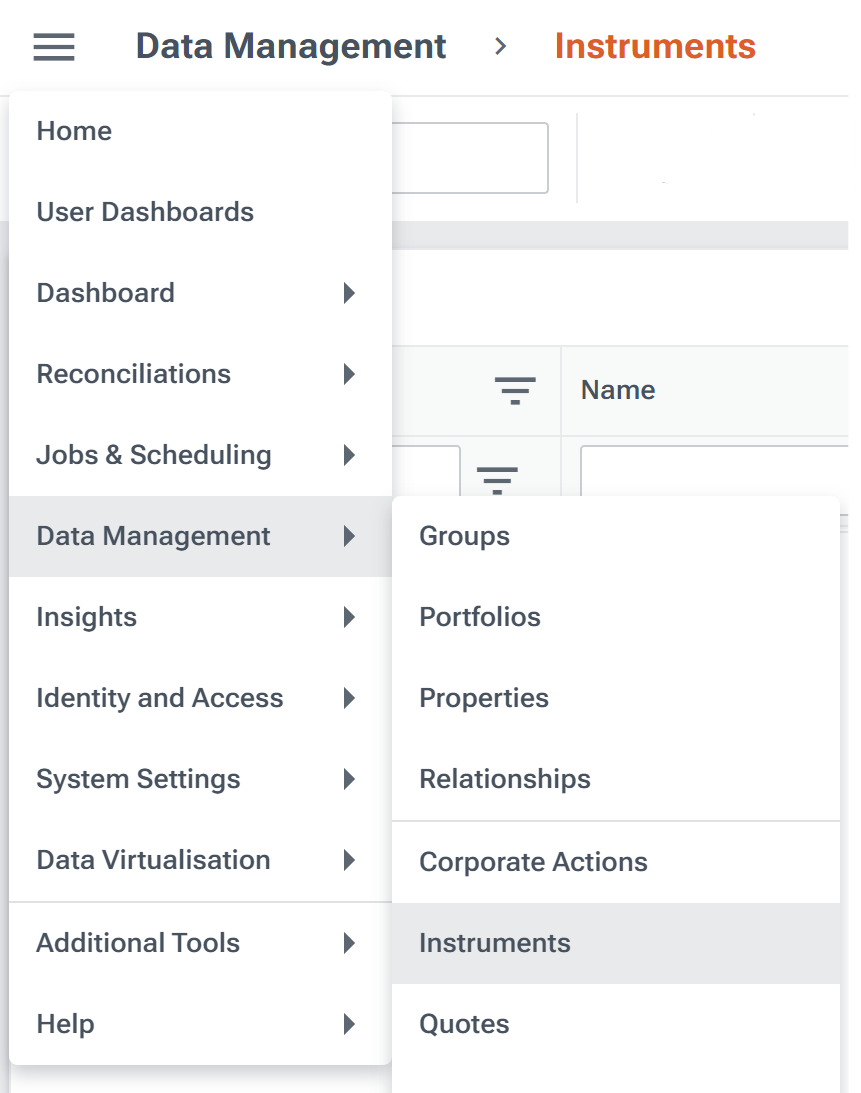

Providing you have appropriate permissions, you can interact with instruments using the LUSID web app, via the Data Management > Instruments menu:

Alternatively, you can interact with instruments programmatically:

Using the LUSID REST API

Using the LUSID SDK in various languages

If you have a Luminesce license, using dedicated read and write providers.

Explanation: See the big picture

Tutorials: Get started by doing something tangible

Populating the LUSID instrument master from different data sources

Handling bond coupon, principal and maturity instrument lifecycle events

Handling FxForward settlement and maturity instrument lifecycle events

Reference: Understand concepts and implications

How does LUSID calculate exposure, accrued interest, compound interest, amortisation/accretion and yield to maturity and duration?

How-to guides: Get something done