LUSID enables you to value:

One or more transaction portfolios.

All the portfolios in a portfolio group.

Notional quantities of arbitrary instruments. This might be useful to value ‘holdings’ without setting up a containing portfolio.

A fund of funds portfolio that ‘looks through’ into securitised portfolios to value child holdings individually. More information.

You must specify a valuation schedule that comprises either a particular day and time, or multiple days in a range.

Valuation is a complex process that requires you to:

Load suitable and timely market data into appropriate LUSID stores for each day in the valuation schedule.

Create a recipe that locates this market data and specifies pricing models appropriate to the types of instruments you wish to value.

Choose a set of metrics to report that are sorted, filtered, grouped and aggregated meaningfully.

To get started, we recommend you work through our valuation checklist.

Subsequently, you can:

Access a manifest to understand how LUSID has generated valuation results.

Create an A2B report to understand precisely how valuations have changed between two points in time.

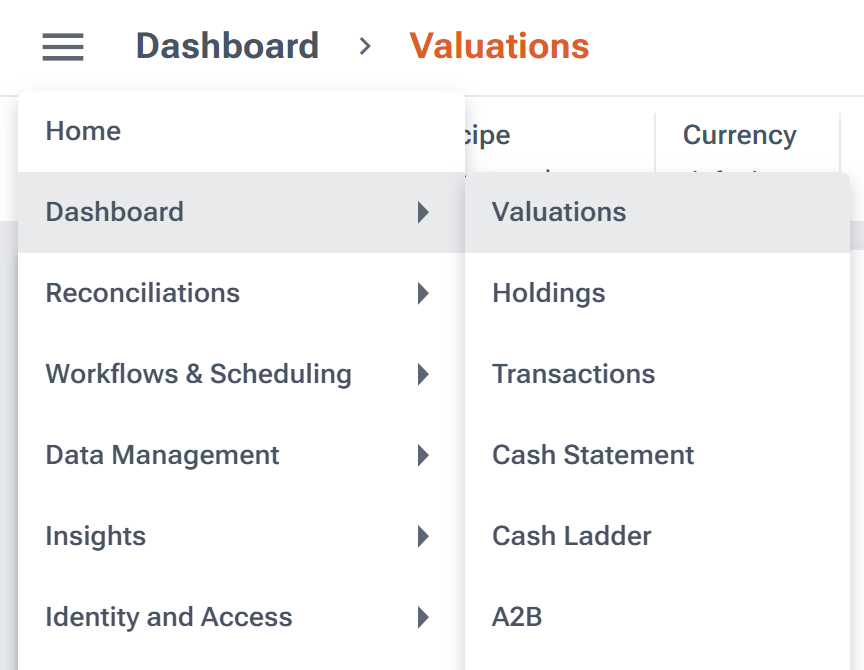

Providing you have appropriate permissions, you can perform a valuation in the LUSID web app, using Dashboard > Valuations:

Alternatively, you can perform a valuation programmatically:

Using the APIs in the Aggregation collection.

If you have a Luminesce license, using the Lusid.Portfolio.Valuation provider.

Explanation: See the big picture

Tutorials: Get started by doing something tangible

Getting started: constructing a simple recipe to value equities using mid prices

Creating an A2B report to understand how valuations change over time

Reference: Understand concepts and implications

Including properties and derived properties in valuation reports

Grouping and aggregating metrics to create a meaningful valuation report

How-to guides: Get something done