A recipe has a market object that you must populate so LUSID can locate and retrieve suitable market data for each type of instrument you wish to value:

For simple exchange-traded instruments such as equities, you are likely to require market prices held in the LUSID Quote Store. Note you can override market prices in some circumstances using holding-level data such as unit cost or last traded price.

For complex exchange-traded or OTC instruments, you are likely to require interest rate, discounting or credit curves and/or volatility surfaces held in the LUSID Complex Market Data Store.

For any instrument (including a cash instrument) held in a different currency to the portfolio currency, you are likely to require FX rates held in the LUSID Quote Store.

Note: You can call APIs to check the quality/quantity of market data required for the valuation operation you are trying to perform. See how to do this.

By default, a recipe must be able to locate market data that is valid ~ one day prior to each date in the valuation schedule. The precise validity period is determined by the valuation time. For example, if you are valuing a portfolio containing a single equity on:

7 March 2022, the time defaults to 00:00:00 and the recipe must be able to locate at least one market price for that equity (and an FX rate, if applicable) effective 6 March 00:00:00 -> 7 March 00:00:00. Prices effective 5 March or earlier, or 7 March later than midnight are not valid.

7 March 2022 17:00:00, the recipe must be able to locate at least one market price effective 6 March 00:00:00 -> 7 March 17:00:00.

7 March 2022 23:59:59, the recipe must be able to locate at least one market price effective 6 March 00:00:00 -> 7 March 23:59:59.

In other words, there is an automatic look back, or ‘grace’, period of between 24 and 48 hours. You can specify an explicit quoteInterval to look back further than this if you wish.

Understanding market data rules

For each category of market data (that is, market price, FX rate, interest rate curve and so on) you are required to locate you should specify a market data rule in the marketRules array and/or groupedMarketRules array of the market object of your recipe. Consider the following example, of three market data rules in the marketRules array intended for a portfolio valuation on 7 March 2022:

.png)

Note the following:

Each market data rule is self-contained and must contain all the information required to locate a particular category of market data in an appropriate store.

Market data rules are processed in order. For each category of market data (as determined by its

key), LUSID attempts to locate market data using the first matching rule found, unless overridden for particular instruments. If no market data can be located (and no override is in place), LUSID tries the next matching rule.You can provide multiple rules for the same

keyin order to provide fallback logic. For example, you could have two rules forQuote.Figi.*that are identical except the first has asupplierofDataScopeand the second asupplierofBloomberg. Prices from Refinitiv would be preferred, but the recipe would fall back to Bloomberg if no Refinitiv prices could be found.You can provide more sophisticated fallback behavior by specifying market data rules in the

groupedMarketRulesarray in addition to themarketRulesarray. More information.You can perform operations such as taking the highest or latest price from a group of providers, or even synthesising an average price, by specifying market data rules in the

groupedMarketRulesarray. More information.You can specify ultimate fallback behaviour for market prices (not FX rates or complex market data) by using holding-level pricing data stored per portfolio, such as unit cost or last traded price. More information.

Summary of fields in a market data rule

For information on all the fields and allowed values in a market data rule, examine the API reference (expand the configurationRecipe/market/marketRules section):

.png)

The following table provides a summary. Note in particular that:

The

keyfield defines the category of market data to locate.Given the category, all the other fields define the rule's criteria for retrieving appropriate data.

Market data rule field | Status | Applicable LUSID market data store(s) | Explanation | Matching market data field in store |

|---|---|---|---|---|

| Mandatory | Quote, Complex Market Data | A dot-separated string specifying the category of market data to locate, and implicitly the store in which to locate it. See the table below for more information. | n/a |

| Mandatory | Quote, Complex Market Data | The market data vendor. This value must match the value of the market data |

|

| Optional | Quote, Complex Market Data | The sub-supplier to the market data vendor (above). This value must match the value of the market data |

|

| Mandatory | Quote, Complex Market Data | This value must match the |

|

| Mandatory | Quote | If the rule locates market data in the Quote Store, this value must match the value of the If the rule locates market data in the Complex Market Data Store, omit this field. |

|

| Mandatory | Quote | If the rule locates market data in the Quote Store, this value must match the value of the If the rule locates market data in the Complex Market Data Store, omit this field. |

|

| Optional | Quote, Complex Market Data | Specifies a 'look back' period for market data longer than the implicit default of You can use the Note if you choose | n/a |

| Optional | Quote, Complex Market Data | Defaults to | n/a |

More information on the key field

The following table explains the key field in a market data rule in more detail:

Market data category | LUSID market data store |

| Examples | |

|---|---|---|---|---|

Quote Store |

|

| ||

|

| |||

Data loaded with |

|

| ||

Data loaded with |

|

| ||

Data loaded with |

|

| ||

Discount factor curve |

|

| ||

FX forward curve |

|

| ||

Interest rate projection curve |

|

| ||

Credit curve |

|

| ||

Equity volatility surface |

|

| ||

FX volatility surface |

|

| ||

Interest rate volatility surface |

|

| ||

Resolving market data errors

When you call the GetValuation API, you may see a MarketResolverFailure similar to the one below if one or more market data rules fails to locate suitable market data in an appropriate store. The first step is to make sure field values in the market data rule match those in market data objects according to the table above. If they do, you can try setting the allowPartiallySuccessfulEvaluation pricing model option to True to relax validation and call the API again, though of course missing market data will not be used in calculations:

Overriding market data rules for particular instruments

You have the option to specify market data rules in the specificRules array that only apply to a matching set of instruments. If you do, these rules are preferred over rules in the marketRules array for just those instruments.

Consider the following example, of one standard MarketDataKeyRule object in the marketRules array sourcing market prices for instruments from a particular market data provider, and two MarketDataSpecificRule objects in the specificRules array specifying preferential providers for:

Equity instruments with a particular base currency.

Instruments of any type with a particular property applied:

Note the following:

Rules in the

specificRulesarray are processed first, before rules in themarketRulesarray.You can have any number of rules in the

specificRulesarray.The order of rules in the

specificRulesarray is significant; for each instrument, LUSID attempts to locate market data using the first matching rule found. If no market data can be located, LUSID tries the next matching rule.

For each rule, you can match instruments using any of the following characteristics in a DependencySourceFilter object:

Characteristic | Field in | Allowed values |

|---|---|---|

Instrument type |

| Any supported LUSID instrument type. |

Asset class |

| LUSID automatically categorises instrument types into asset classes. |

Instrument base currency |

| Any ISO 4217 currency code. |

Whether a holding in the instrument in a portfolio has positive units or negative units |

|

|

Instrument feature |

| One or more OTC instrument features; see below. |

Instrument property |

| One or more instrument properties; see below. |

Matching instruments on features and properties

You can match instruments on any combination of:

Custom properties in the

Instrumentdomain (including derived properties), for exampleInstrument/MyProperties/Region.System properties in the

Instrumentdomain, for exampleInstrument/default/Scope.Features for OTC instruments, for example

Instrument/Features/ExerciseType.

To do this, you can specify any number of AddressKeyFilter objects in the addressKeyFilters array in a DependencySourceFilter object. For each:

The

leftfield must reference the 3 stage key of the property or feature.The

operatorfield must either beeqorneq.The

rightfield must be a string value on which to match, with aresultValueTypeofResultValueString. Note this means only properties with an underlying data type ofStringare currently supported.

Consider the following example, of three AddressKeyFilter objects that together combine to match only instruments that are American options with a credit rating other than B or B+:

Grouping market data rules and performing preference operations

You can specify market data rules in the groupedMarketRules array as well as, or instead of, the marketRules array:

You might specify market data rules in both arrays in order to provide sophisticated fallback behavior from a preferred supplier of quotes to a group of secondary suppliers.

You might specify market data rules in just the

groupedMarketRulesarray to perform an operation such as taking the most recent or highest price from a group of suppliers, or even synthesising an average price.

You can of course combine these use cases to perform operations on a group of secondary suppliers.

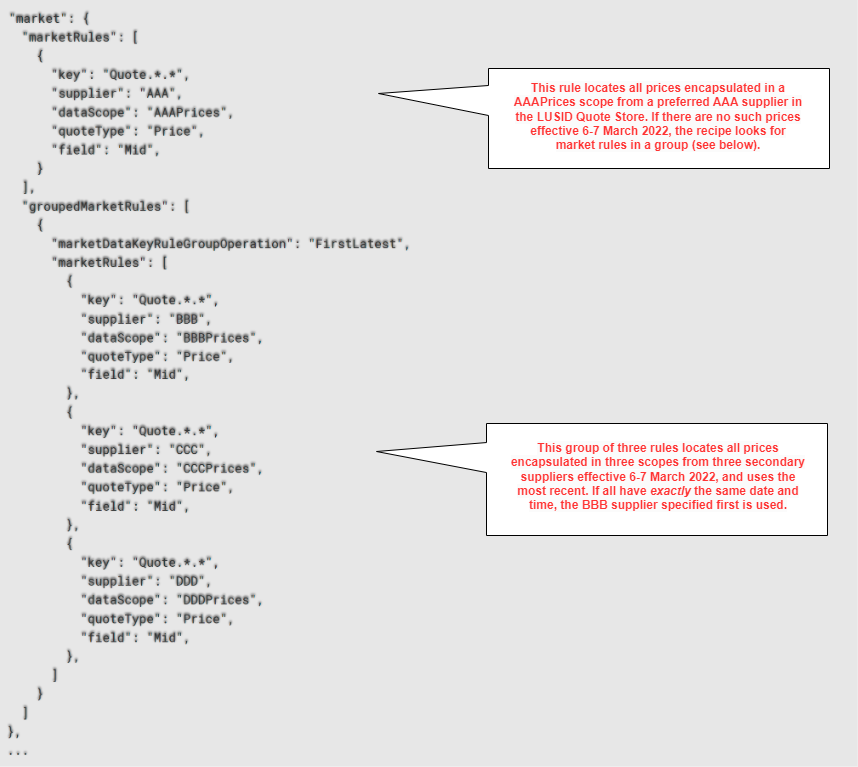

Consider the following example, of a market object with one market data rule for prices in the marketRules array and three inside a single group in the groupedMarketRules array, intended for a portfolio valuation on 7 March 2022. Note the operation on the group of rules is FirstLatest:

Note the following:

A recipe should have at least one market data rule in order to be functional. It can be in the

marketRulesarray, or on its own in a group in thegroupedMarketRulesarray.You can have any number of market data rules in the

marketRulesarray, and any number of rules in any number of groups in thegroupedMarketRulesarray.LUSID reads the

marketRulesarray first, then thegroupedMarketRulesarray.Within the

marketRulesarray, the order of market data rules is significant.Within the

groupedMarketRulesarray, the order of groups is significant. The order of market data rules within a group is significant in some circumstances, depending on the operation being performed.Within the

groupedMarketRulesarray, all market data rules must have the samekeyandquoteType. One exception is forquoteTypewith theFirstLatestoperation, where you can mix thePriceandDirtyPricequote types.LUSID uses the first matching rule found for a particular category of market data.

The following marketDataKeyRuleGroupOperations are available:

Operation | Explanation |

|---|---|

| The rule retrieving the most recent market data item (market price, FX rate and so on) is used. If all items were loaded with exactly the same date and time, the rule specified first in the group is used. |

| The rule retrieving the lowest value market data item is used. If all items have exactly the same value, the rule specified first in the group is used. |

| The rule retrieving the highest value market data item is used. If all items have exactly the same value, the rule specified first in the group is used. |

| These operations are different in that LUSID synthesises a new market data item rather than using a rule to retrieve an existing item. See the section below. |

|

Example: Synthesising an average market data item

You can request that LUSID retrieves market data items from all the rules in a group and synthesises a new market data item representing an average:

Choose the

AverageOfAllQuotesoperation if you want the request to fail if a single rule in the group fails to retrieve a market data item.Choose the

AverageOfQuotesFoundoperation to ignore failures unless all rules fail to retrieve items.

For example, imagine you have upserted to the LUSID Quote Store the following three market prices for a particular stock:

Data field | Price #1 | Price #2 | Price #3 | Notes |

|---|---|---|---|---|

|

|

|

| |

|

|

| This field is optional when upserting. | |

|

|

|

| In order to synthesise an average, all instrument identifier types must be the same. |

|

|

|

| In order to synthesise an average, all values must identify the same instrument. |

|

|

|

| In order to synthesise an average, all quote types must be the same. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| In order to synthesise an average, all currency units must be the same. |

|

|

| This field is optional when upserting; it defaults to 1. | |

|

|

| This field is optional when upserting. | |

|

|

|

| This field is automatically populated by LUSID. |

|

|

|

| This field is automatically populated by LUSID. |

...and created a recipe with the following three market data rules in a group with the AverageOfAllQuotes operation:

Assuming all three original market prices can be located, LUSID synthesises the following average price:

Data field | Synthesised value | Notes |

|---|---|---|

|

| The provider is always set to this value, irrespective of the original providers. |

|

| The prefix is |

|

| |

|

| |

|

| |

|

| The prefix is |

|

| The latest original datetime is used. |

|

| In this example, the original scale factors are different, so the synthesised value is unitised. The calculation is as follows: Original price #1: |

|

| |

|

| In this example, since the synthesised value is unitised, the scale factor is set to 1. If the original scale factors were the same and not 1, then this field is set to that scale factor. |

|

| The prefix is |

|

| The user is always set to this value, irrespective of the original users. |

|

| The as at datetime of the valuation operation is used. |

Note a synthesised market data item is not upserted to the Quote Store, so it cannot be retrieved by an API such as ListQuotesForScope. However, it is available in the manifest for a valuation operation.

Overriding market prices or falling back to holding pricing data

If the valuation operation you want to perform requires a market price (note, not an FX rate or complex market data), you can optionally specify override and/or fallback rules to use holding-level pricing data such as unit cost or last traded price:

You might specify an override rule to use holding-level data in preference to a market price stored in the Quote Store.

You might specify a fallback rule to use holding-level data if a market price cannot be located in the Quote Store.

Rules can be global or specific; that is, apply to every type of instrument or just to a particular type or asset class. Note if you specify a global override rule and no specific overrides then LUSID never attempts to locate market prices in the Quote Store.

Note: Holding-level pricing data may differ between portfolios, so if you are valuing multiple portfolios this may mean they are valued differently, even with equal positions in the same instruments.

To do this, specify a HoldingPricingInfo object in the pricing object of a recipe (not the market object):

.png)

The following pricing data is available for each holding in any portfolio being valued:

Available pricing data | Explanation |

|---|---|

| The total |

| The total |

| The |

Example: Specifying override rules

In the following example, if the valuation operation requires market prices:

Instruments of type

ComplexBondare valued usingUnitAmortisedCost.Instruments of type

Equitytrading in euros are valued usingLastTradedPrice.Instruments of every other type are valued using prices located in the Quote Store. Since no global

overrideFieldis provided, a market data error occurs if no such prices can be found:

Example: Specifying fallback rules

In the following example, if the valuation operation requires market prices that cannot be located in the Quote Store:

Instruments of type

Bondare valued usingLastTradedPrice.Instruments of every other type are valued using

UnitCost: