A corporate action is an elective activity that impacts the shareholders and/or bondholders of a company, for example a dividend, stock split or spin off. See the list of dedicated corporate action events.

You can create a corporate action source in LUSID and upload your stream of corporate actions from an external provider to it. You can then subscribe any number of transaction portfolios to the corporate action source, and LUSID automatically applies corporate actions to portfolios with holdings in the underlying instruments on appropriate dates.

For example, you could upload a corporate action representing a Microsoft cash dividend of $0.20 per share that has an ex-dividend date of 6 February and a payment date of 10 February. For each portfolio with a holding in Microsoft on 6 February, LUSID automatically increases the cash balance by 20 cents per unit held on 10 February (or an equivalent amount in an elective currency). See this in action.

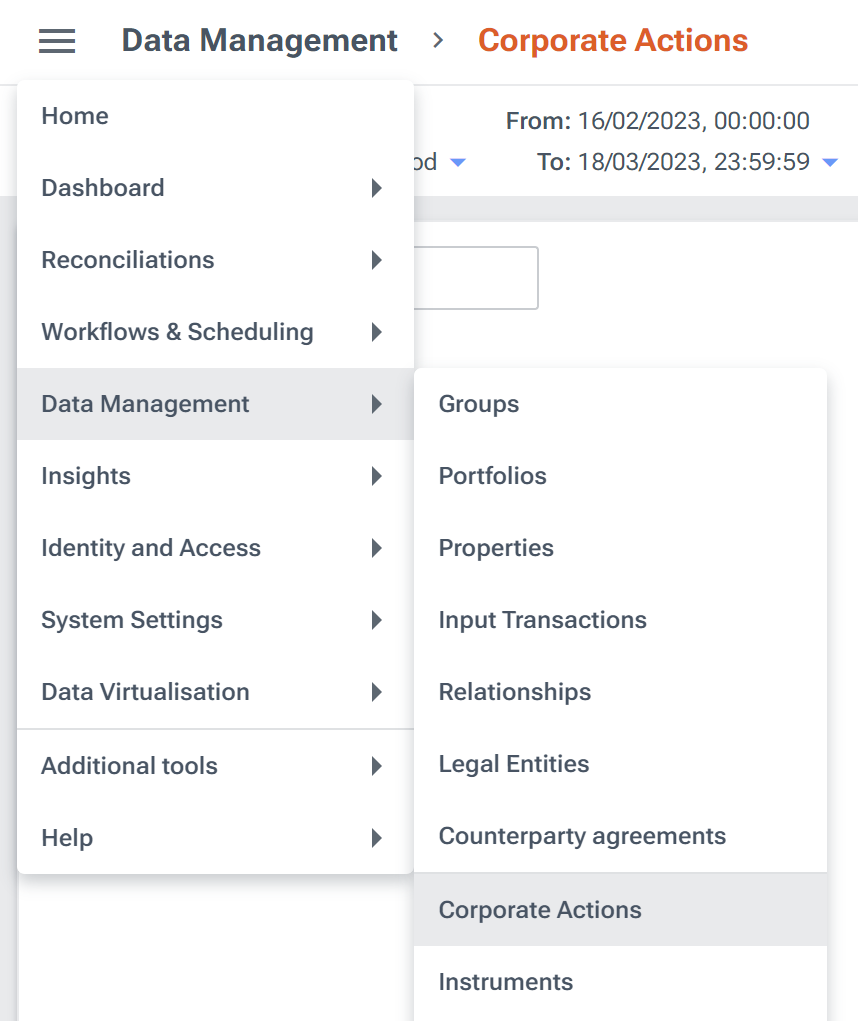

Providing you have appropriate permissions, you can create a corporate action source and upload corporate actions to it using the LUSID web app, via the Data Management > Corporate Actions dashboard:

Alternatively, you can perform these operations programmatically:

Using the LUSID API endpoints in the

Corporate Action Sourcescollection.Using equivalent methods in the LUSID SDK in various languages.

If you have a Luminesce license, using dedicated read and write providers.

Explanation: See the big picture

Tutorials: Get started by doing something tangible

Reference: Understand concepts and inplications

Loading an event instruction to override a corporate action event for a particular portfolio

Modelling unsupported corporate actions as transition events

How-to guides: Get something done