Providing you have suitable access control permissions, you can:

Required reading: What is a recipe?

Creating a recipe by hand

Using the LUSID REST API

Call the UpsertConfigurationRecipe API, specifying at a minimum:

A

scopeandcodethat together uniquely identify the recipe.At least one market data rule in the

marketRulesarray of themarketsection that enables LUSID to retrieve market data suitable to value the instruments held.

By default, a recipe uses a built-in pricing model for each type of instrument (such as SimpleStatic for instruments of type Equity); you can specify vendor model rules to choose more sophisticated pricing models if you wish. A recipe also has many options that default to sensible values; you can choose to override these.

For example, to create a simple recipe that might be suitable to value a portfolio of equities using market prices that are:

Supplied by EDI

Loaded into the LUSID Quote Store using FIGI identifiers

Encapsulated in a

MyQuoteScope:

curl -X POST "https://<your-domain>.lusid.com/api/api/recipes"

-H "Content-Type: application/json-patch+json"

-H "Authorization: Bearer <your-API-access-token>"

-d '{

"configurationRecipe": {

"scope": "Recipes",

"code": "SimpleEquityPricer",

"market": {

"marketRules": [

{

"key": "Quote.Figi.*",

"supplier": "Edi",

"dataScope": "MyQuoteScope",

"quoteType": "Price",

"field": "mid",

"quoteInterval": "2D.0D"

}

]

},

"description": "Simple recipe to value equities using price * units"

}

}'Using the LUSID web app

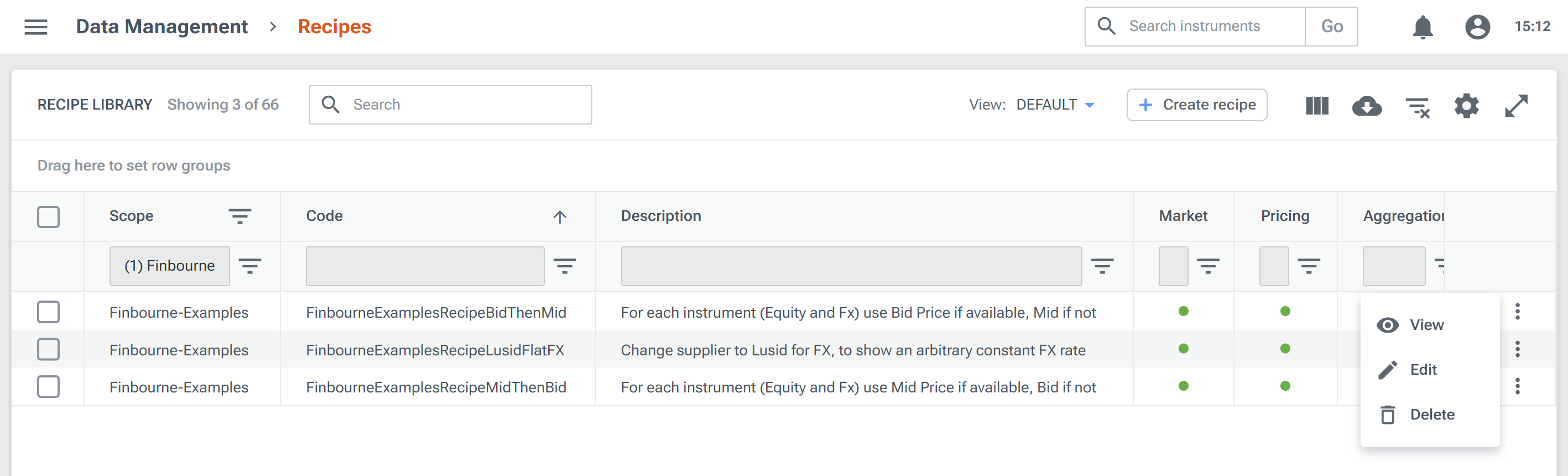

This functionality is coming soon. At the moment, you can list your recipes by signing into the LUSID web app and navigating to the Data Management > Recipes dashboard.

To examine a recipe in JSON form, select it and click the View or Edit button. Note a Create recipe button exists but currently there is no wizard to help you do so.

Asking LUSID to generate a recipe for you

You can specify a portfolio to value and characteristics of appropriate market prices in the LUSID Quote Store and ask LUSID to generate a recipe that calculates the value of each position by multiplying the price of the underlying instrument by the number of units held.

Note: Alternatively, you can supply a simple recipe and ask LUSID to create a more sophisticated recipe for you.

To do this:

Call the GenerateConfigurationRecipe API, specifying:

The

scopeandcodeof a transaction portfolio to value.One or more quote

scopesencapsulating prices for the underlying instruments loaded into the LUSID Quote Store.

For example, to value a portfolio with a scope of Growth and code of UKEquities using prices encapsulated in a quote scope of MyQuoteScope:

curl -X POST "https://<your-domain>.lusid.com/api/api/aggregation/Growth/UKEquities/$generateconfigurationrecipe"

-H "Content-Type: application/json-patch+json"

-H "Authorization: Bearer <your-API-access-token>"

-d '{

"recipeCreationMarketDataScopes": [

"MyQuoteScope"

],

"effectiveAt": "2022-11-01"

}'LUSID might generate a recipe like the one below (note all recipe options are set to sensible default values):

{

"scope": "Growth",

"code": "LUSID_generated_recipe",

"market": {

"marketRules": [

{

"key": "Quote.Figi.*",

"supplier": "Lusid",

"dataScope": "MyQuoteScope",

"quoteType": "Price",

"field": "mid",

"priceSource": "",

"sourceSystem": "Lusid"

},

{

"key": "Fx.*.*",

"supplier": "Lusid",

"dataScope": "default",

"quoteType": "Price",

"field": "mid",

"priceSource": "",

"sourceSystem": "Lusid"

}

],

"suppliers": {},

"options": {

"defaultSupplier": "Lusid",

"defaultInstrumentCodeType": "LusidInstrumentId",

"defaultScope": "default",

"attemptToInferMissingFx": false,

"calendarScope": "CoppClarkHolidayCalendars",

"conventionScope": "Conventions"

},

"specificRules": []

},

"pricing": {

"modelRules": [],

"modelChoice": {},

"options": {

"modelSelection": {

"library": "Lusid",

"model": "SimpleStatic"

},

"useInstrumentTypeToDeterminePricer": false,

"allowAnyInstrumentsWithSecUidToPriceOffLookup": false,

"allowPartiallySuccessfulEvaluation": false,

"produceSeparateResultForLinearOtcLegs": false,

"enableUseOfCachedUnitResults": false,

"windowValuationOnInstrumentStartEnd": false,

"removeContingentCashflowsInPaymentDiary": false,

"useChildSubHoldingKeysForPortfolioExpansion": false,

"validateDomesticAndQuoteCurrenciesAreConsistent": false

},

"resultDataRules": []

},

"aggregation": {

"options": {

"useAnsiLikeSyntax": false,

"allowPartialEntitlementSuccess": false,

"applyIso4217Rounding": false

}

},

"inheritedRecipes": [],

"description": "- recipe has been supplemented with additional market data rules",

"holding": {

"taxLotLevelHoldings": true

}

}