A recipe has a pricing section that you must populate if you wish to change the default pricing model LUSID provides for each instrument type:

Instrument type | Default pricing model | Effect of model |

|

| For a bond, sums the remaining coupons and the principal. For an FxForward, sums the two legs with the foreign converted to domestic at the spot rate. |

All other types |

| Multiplies the number of units held by the market price on the valuation date. |

You can change the default for any instrument type except Equity to provide a more suitable or sophisticated result. You can even conditionally select different pricing models for the same instrument type.

Note: The combination of instrument type and pricing model impacts the quantity and quality of market data required. Find out more about this.

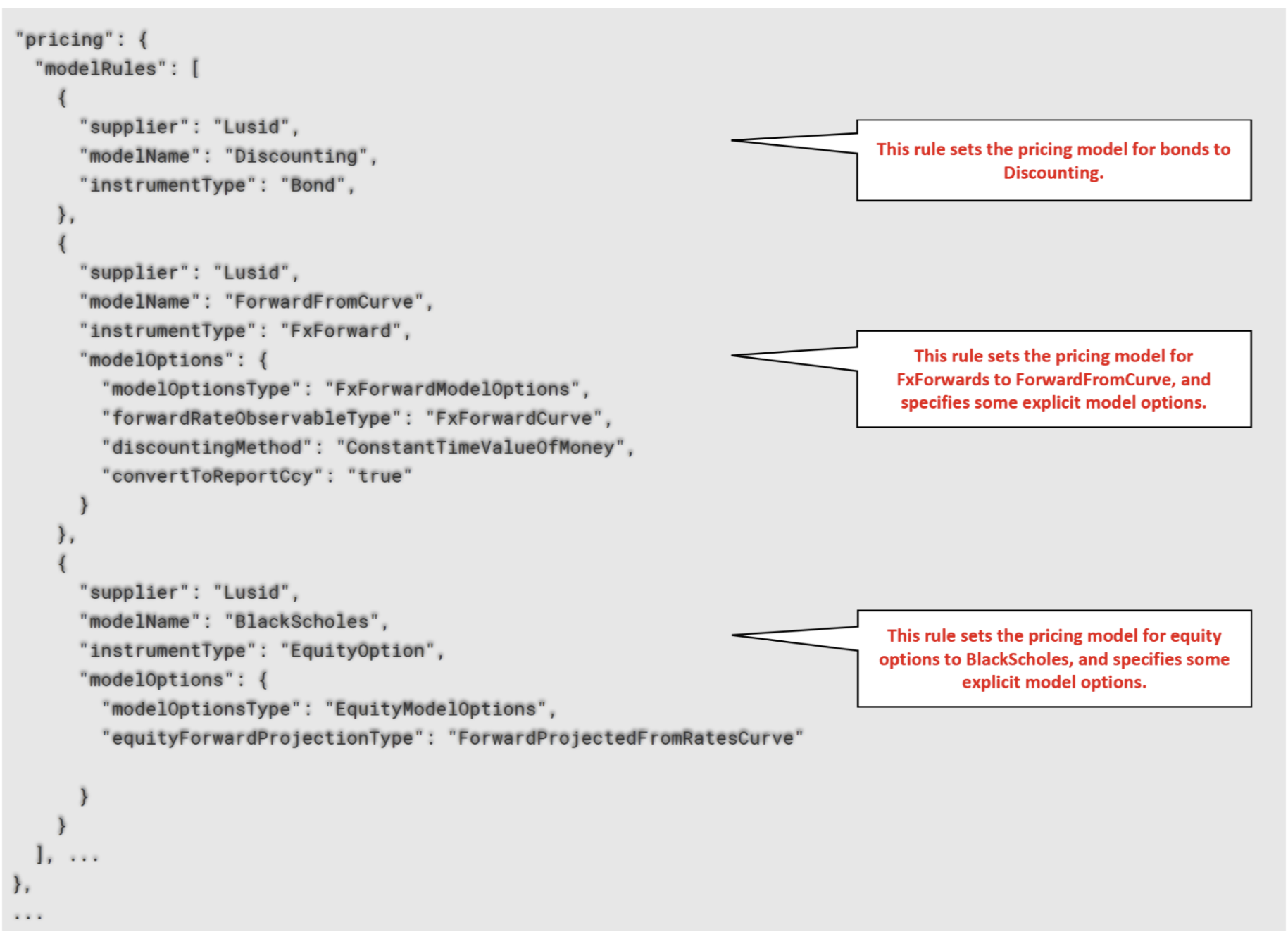

For each instrument type whose pricing model you wish to change, specify a vendor model rule in the modelRules array of the pricing section of your recipe. Consider the following example, of three vendor model rules to change the default models for bonds, FxForwards and equity options (all others are left unchanged):

For information on all the fields and allowed values in a vendor model rule, examine the API reference (expand the configurationRecipe/pricing/modelRules section). The following table summarises core fields:

Vendor model rule field | Status | Explanation |

| Mandatory | Defaults to |

| Mandatory | If |

| Mandatory | If |

| Optional | Specify if you want to conditionally selects different pricing models for the same instrument type. |

| Optional | Configure pricing models for certain instrument types. If

For all other instrument types, omit this field to use the default value of

For more information on the option fields available, examine the API reference (expand the

|

Selecting different pricing models for the same instrument type

You can conditionally select pricing models based on custom properties added to instruments, on instrument features, or both.

For example, you might want to specify that:

American FX option contracts are valued using the

BjerksundStensland1993pricing model.European FX option contracts sourced from Bloomberg are valued using the

BlackScholespricing model.European FX option contracts sourced from UBS are valued using the

Discountingpricing model.

To do this, specify multiple vendor model rules for the same instrument type and distinguish them using the addressKeyFilters field:

The

leftfield must reference the 3 stage key of either a property or a feature. In the example below,Instrument/FX/DataProvideris a property added to instruments of typeFxOptionto record the original data provider, whileInstrument/Features/ExerciseTypeis a feature key referencing one of the available exercise types for FX option contracts in LUSID.The

operatorfield must either beeqorneq.The

rightfield must be a stringvalueon which to match, with aresultValueTypeofResultValueString. Note this means only properties with an underlying data type ofStringare currently supported.

Note: Vendor model rules are processed in the order they are specified in a recipe. The first matching rule found is used. Instruments that do not match any rules fall back to using the default pricing model for the instrument type, which is

SimpleStaticfor FX option contracts.

"pricing": {

"modelRules": [{

"supplier": "Lusid",

"instrumentType": "FxOption",

"addressKeyFilters": [{

"left": "Instrument/Features/ExerciseType",

"operator": "eq",

"right": {

"value": "American",

"resultValueType": "ResultValueString"

}

}],

"modelName": "BjerksundStensland1993"

},

{

"supplier": "Lusid",

"instrumentType": "FxOption",

"addressKeyFilters": [{

"left": "Instrument/Features/ExerciseType",

"operator": "eq",

"right": {

"value": "European",

"resultValueType": "ResultValueString"

}

},

{

"left": "Instrument/FX/DataProvider",

"operator": "eq",

"right": {

"value": "Bloomberg",

"resultValueType": "ResultValueString"

}

}],

"modelName": "BlackScholes"

},

{

"supplier": "Lusid",

"instrumentType": "FxOption",

"addressKeyFilters": [{

"left": "Instrument/Features/ExerciseType",

"operator": "eq",

"right": {

"value": "European",

"resultValueType": "ResultValueString"

}

},

{

"left": "Instrument/FX/DataProvider",

"operator": "eq",

"right": {

"value": "UBS",

"resultValueType": "ResultValueString"

}

}],

"modelName": "Discounting"

}],

...

For a more detailed demonstration of conditional pricing model selection, examine this Jupyter Notebook.

.png)