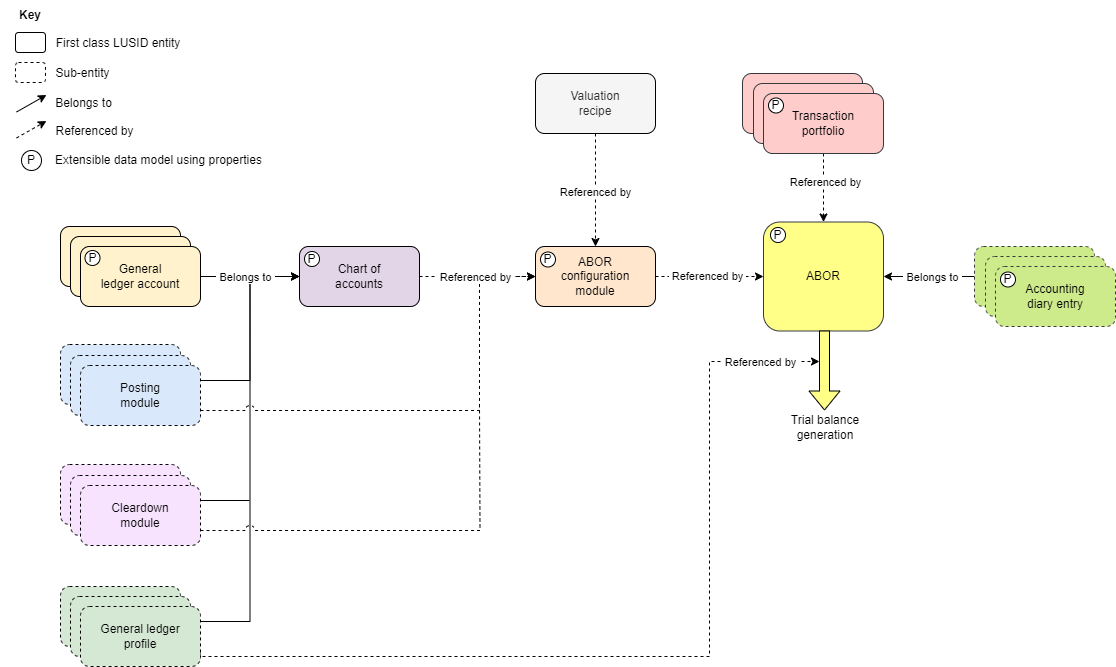

An ABOR marshalls a set of components that together enable LUSID to provide an accounting view of all the economic activity in one or more transaction portfolios between two points in time.

Note: Setting up an ABOR is a prerequisite for setting up a fund.

For each item of economic activity in those portfolios, LUSID generates a pair of journal entry lines: one representing a (positive) debit amount for posting to a specific general ledger account, and the other an equal and opposite (negative) credit amount for posting from a different account, in accordance with the double-entry system.

The components that comprise an ABOR are currently as follows:

Step 1: Create a chart of accounts

A chart of accounts (CoA) is an index of all the financial accounts in the general ledger of a company. You must create a CoA before you can add general ledger accounts to it.

Step 2: Add general ledger accounts to the CoA

A general ledger account represents either assets, liabilities, income, expenses, capital or revenue. You can add as many accounts to a CoA as you need, and update the set at any time.

Step 3: Add at least one posting module with posting rules to the CoA

A posting module contains an ordered set of posting rules that post journal entry line debit and credit amounts to specific general ledger accounts.

You might add more than one posting module to a CoA in order to post the same economic activity in different ways. You can choose which posting module(s) to use, and the evaluation order if more than one, when you create an ABOR configuration module (see step 6).

Step 4: Optionally, add one or more cleardown modules with cleardown rules to the CoA

A cleardown module is similar to a posting module, except with the specific purpose of transfering amounts in P&L accounts to other accounts at year end, so accurate year-to-date P&L figures can be calculated for the next year.

You can add more than one cleardown module to a CoA if you wish, and choose which cleardown module(s) to use, and the evaluation order if more than one, when you create an ABOR configuration module (see step 6).

Step 5: Optionally, add one or more general ledger profiles with mappings to the CoA

By default, LUSID reports each general ledger account in a trial balance on a single line, automatically aggregating all the debits and credits in that account. You can apply a general ledger profile to a trial balance to break down account activity according to particular criteria. This might be useful to aggregate debits and credits for one, some or all accounts in a more granular way.

You can add any number of general ledger profiles to a CoA, perhaps to break down account activity in the same trial balance in different ways. You can then select which general ledger profile to use when generating a trial balance (see step 9).

Step 6: Create an ABOR configuration module

You must create an ABOR configuration module to co-ordinate the set of components for an ABOR.

You specify a CoA, nominate one or more posting modules and cleardown modules from that CoA to use (and the evaluation order if more than one), and identify a recipe that is able to value holdings in all portfolios to calculate unrealised gains and losses.

Step 7: Create an ABOR

You must create an ABOR to nominate the portfolio(s) to provide an accounting view of, and specify the ABOR configuration module whose components to use.

You might have multiple ABORs for the same set of portfolios, each with a different ABOR configuration module targeting a different kind of financial report.

Step 8: Optionally, set up an accounting calendar for the ABOR

There are different types of accounting diary entry in LUSID, each with its own creation mechanism, behavior and implications.

For example, you can add an accounting diary entry of type PeriodBoundary to an ABOR by closing or locking a period, and then use that diary entry to generate a trial balance (see step 9). When you do, LUSID persists all the underlying data so the result is always reproducible.

Alternatively, you can generate an ad-hoc trial balance by specifying a datetime, but LUSID does not persist the data.

Step 9: Generate a trial balance for the ABOR

A trial balance is a summary view of all the general ledger accounts underlying an ABOR between two points in time. By default, LUSID reports each account on a single line, automatically aggregating all the debits and credits in that account, and providing an opening and closing statement. You can check that the sum of (positive) debits and (negative) credits for all accounts is zero; in other words, that the ledger balances.

You can generate a trial balance at any time, and optionally apply a general ledger profile in order to break down account activity and aggregate debits and credits at a more granular level.